Revenue-Based

Financing

Key Terms

Financing from €5,000 to €25,000

Term from 3 to 12 months

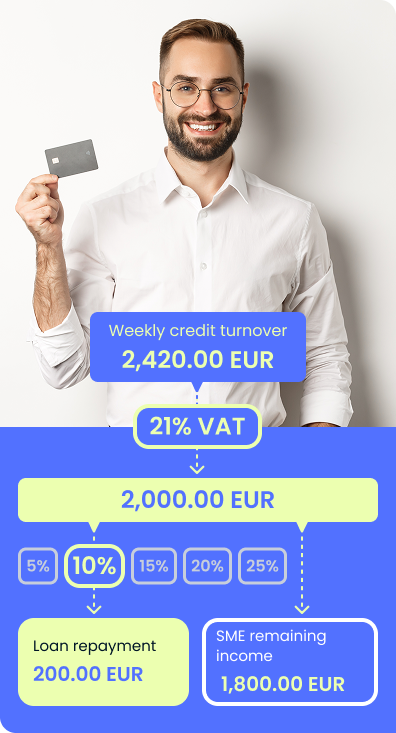

Flexible repayment from 5% to 25% of the company’s weekly income

Receive an indicative offer within 2 hours

What is Revenue-Based Financing?

A type of business financing that allows you to receive up to 25% of your company’s annual revenue. This financing method is highly flexible, as repayments depend on your company’s weekly sales volumes. When your company’s income increases, the repayment amount also increases, allowing the loan to be repaid faster. Conversely, if income decreases, repayments also decrease.

Flexibility / Why?

Weekly payments automatically adjust to the company’s income

Target Audience

Small and medium-sized enterprises with regular revenue turnover

Quick and Easy/ How

Obtain quick financing for working capital to settle with suppliers, replenish inventory, purchase goods/services, or allocate to marketing activities

No Fixed Payments

Loan repayment depends on the company’s weekly income volume. You choose what percentage of the company’s weekly income to allocate for loan repayment

How It Works

01 Sales of Goods and Services

The company sells goods or provides services to customers and receives payment into a bank account

02 Automatic Loan Repayment

Every Monday, a specified maximum percentage (5–25%) of the company’s weekly income is automatically

debited to cover the loan principal and interest

03 Payment Adjustment to Income Fluctuations

Payments adjust to the company’s income fluctuations: in case of a decrease, they decrease; in case of an increase, the loan is repaid faster

Application process

Application Submission

Quickly fill out our online application and receive a response within minutes

Income Analysis

We issue up to 25% of the company’s annual revenue turnover

Offer Reception

Within 2 hours

Financing Reception

Receive funds into the company’s specified bank account

Flexible repayment

Repayment is automatically adjusted to the company’s income

Automatic repayment

1x week

Comparison with

Traditional Loans

Revenue-Based

Financing

Repayment Method

% of revenue

Repayment Schedule

Flexible, income-adjusted

Repayment Frequency

Daily/Weekly/Monthly

Collateral

Often unsecured

Speed

1–3 days

Traditional

Loan

Repayment Method

Fixed monthly payments

Repayment Schedule

Strictly defined, based on terms

Repayment Frequency

Monthly

Collateral

Often requires collateral

Speed

1–4 weeks

Apply for financing now and receive a response within one day. Achieve your business goals with financing that grows alongside your revenue